The Single Strategy To Use For Medicare Advantage Agent

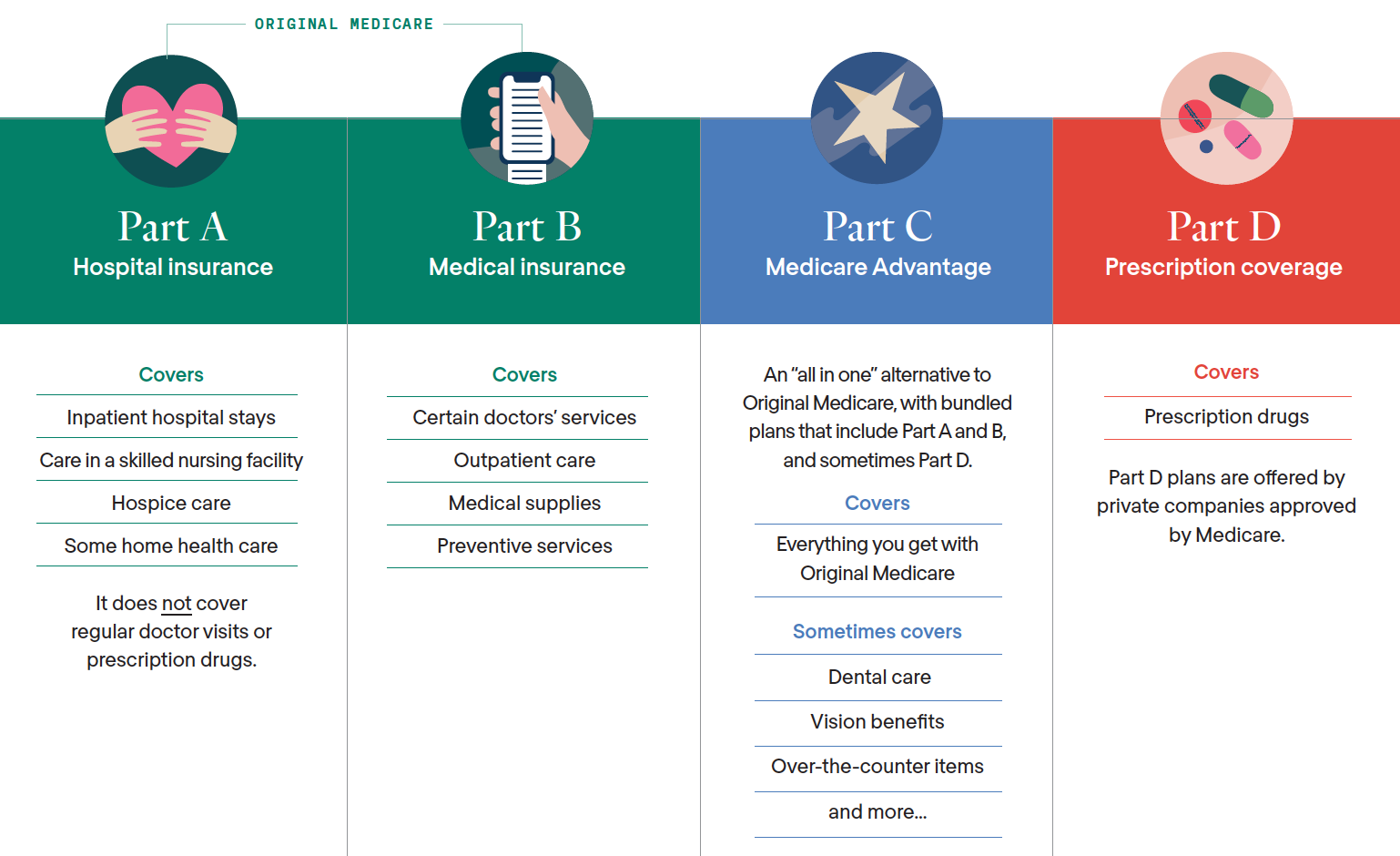

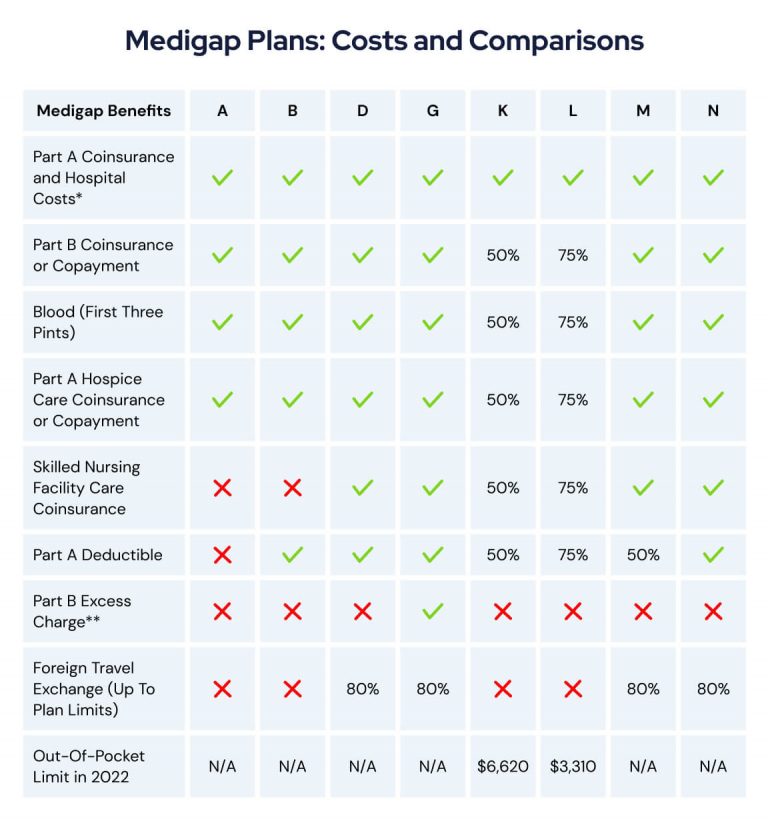

You can use this duration to join the strategy if you really did not earlier. You can additionally utilize it to drop or transform your insurance coverage. Plans with greater deductibles, copayments, and coinsurance have lower costs. However you'll need to pay more expense when you obtain treatment. To discover a company's monetary rating and complaints background, call our Help Line or see our site.

Call the market for additional information. If you purchase from an unlicensed insurer, your claim could go unsettled if the business goes damaged. Call our Customer service or see our website to examine whether a company or agent has a certificate. Know what each plan covers. If you have physicians you intend to keep, make certain they're in the plan's network.

Getting My Medicare Advantage Agent To Work

Make sure your medicines are on the plan's checklist of accepted drugs. A strategy will not pay for medicines that aren't on its list.

The Texas Life and Health Insurance coverage Warranty Association pays insurance claims for health insurance policy. It does not pay claims for HMOs and some other kinds of strategies.

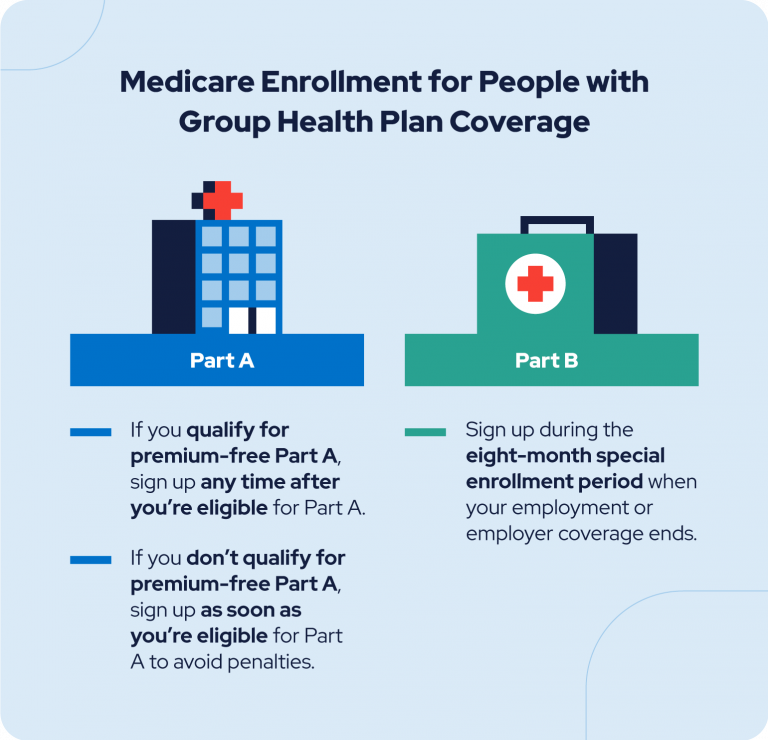

Your spouse and kids likewise can proceed their protection if you take place Medicare, you and your partner separation, or you die. They have to have been on your prepare for one year or be younger than 1 years of age. Their protection will certainly finish if they obtain various other coverage, don't pay the costs, or your company quits supplying health insurance coverage.

Some Ideas on Medicare Advantage Agent You Need To Know

You must inform your employer in writing that you want it. If you proceed your insurance coverage under COBRA, you have to pay the costs yourself. Your company does not have to pay any of your costs. Your COBRA protection will be the same as the coverage you had with your company's plan.

Once you have actually enrolled in a health plan, be sure you understand your plan and the price effects of numerous treatments and services. For example, going to an out-of-network medical professional versus in-network commonly sets you back a consumer much extra for the very same kind of service. When you register you will be offered a certification or evidence of coverage

The 4-Minute Rule for Medicare Advantage Agent

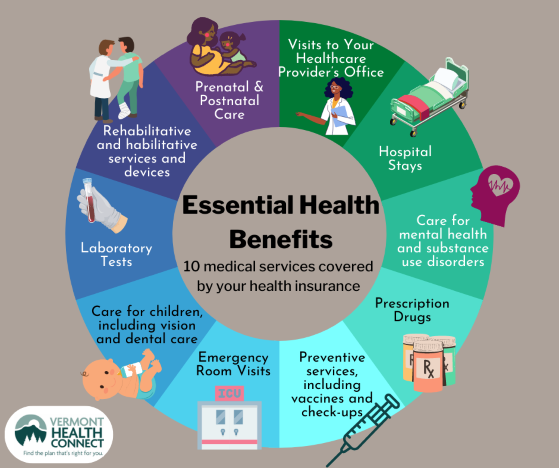

It will likewise tell you if any type of services have constraints (such as maximum quantity that the health insurance will spend for resilient clinical equipment or physical treatment). And it should inform what solutions are not covered whatsoever (such as acupuncture). Do your research, research all the alternatives available, and examine your insurance policy prior to making any choices.

Medicare Advantage Agent for Dummies

When you have a medical procedure or go to, you generally pay your health care carrier (physician, health center, therapist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your section of the service provider's expense. You anticipate your health and wellness plan to pay the remainder of the expense if you are seeing an in-network company.

There are some instances when you might have to file an insurance claim yourself. This might occur when you most likely to an out-of-network provider, when the company does decline your insurance, or when you are traveling. If you need to file your own health and wellness insurance policy case, call the number on your insurance policy card, and the customer support representative can inform you how to file a claim.

Numerous health insurance plan have a time limit for the length of time you have to file a claim, generally within 90 days of the service. After you submit the claim, the health insurance has a limited time (it differs per state) to educate you or your carrier if the wellness strategy has actually accepted or denied the claim.

Medicare Advantage Agent - Truths

If it chooses that a service is not medically essential, the plan may reject or lower settlements. For some health and wellness plans, this clinical necessity read here choice is here are the findings made before treatment. For various other health and wellness strategies, the choice is made when the business obtains an expense from the service provider. The business will send you a description of advantages that details the solution, the amount paid, and any kind of additional quantity for which you may still be accountable.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)